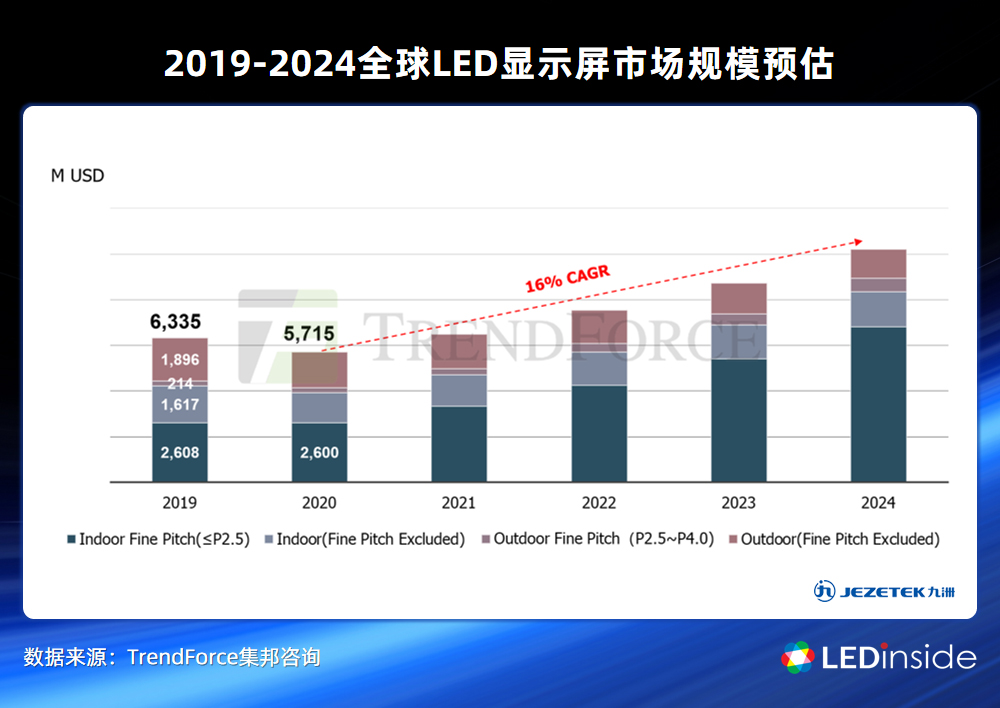

Affected by the spread of the global new crown pneumonia epidemic, TrendForce revised down the global LED display market size in 2020, and estimated it to be US$5.7 billion, down about 10% year-on-year. However, for some specific application areas, such as outdoor transportation, billboards, and some municipal-related applications, it is expected that the second half of the year will pick up and benefit from the government's economic stimulus. Regarding the development in the next few years, if there are no major macroeconomic changes, it is expected that the global LED display will maintain a compound annual growth rate of 16% from 2020 to 2024, of which small-pitch display is still the biggest driving force for market growth.

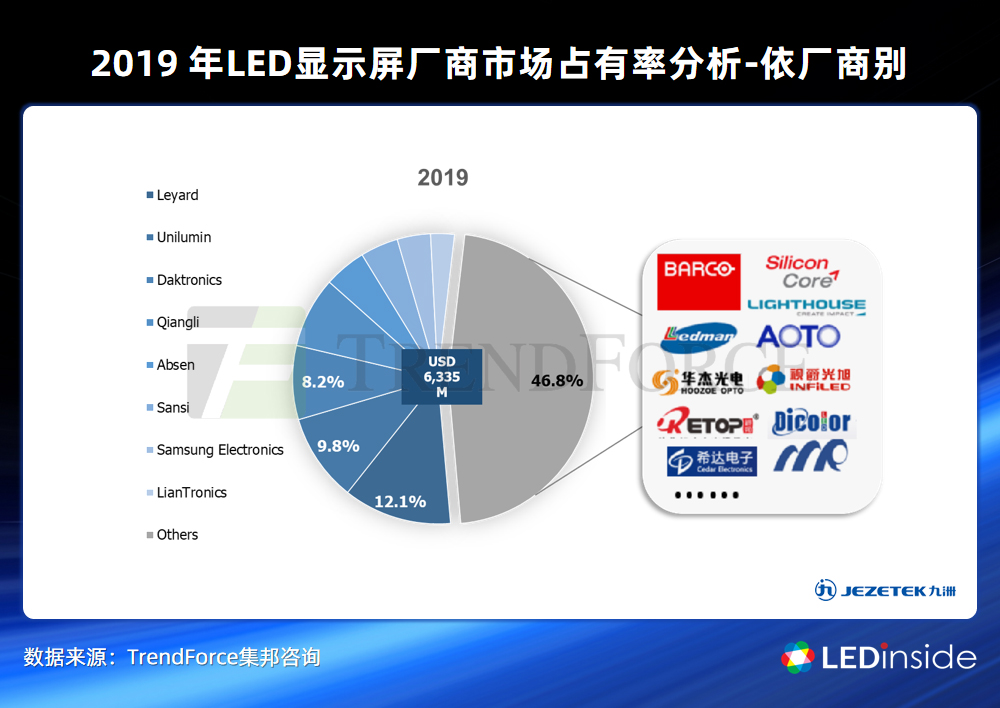

In 2019, the global LED display market size was US$6.335 billion, with CR8 accounting for 53.2%. Among the top eight manufacturers in terms of market share, except for Daktronics, which ranked third, and Samsung, which entered the top seven for the first time in 2019, the rest are all from China. Samsung has been actively shipping Mini LED displays in recent years, and its unit price is high. It made a large contribution to its overall LED display revenue and entered the top seven for the first time. With the participation of more international manufacturers such as Samsung and Sony, the competition for market share ranking will also become more intense in the future.

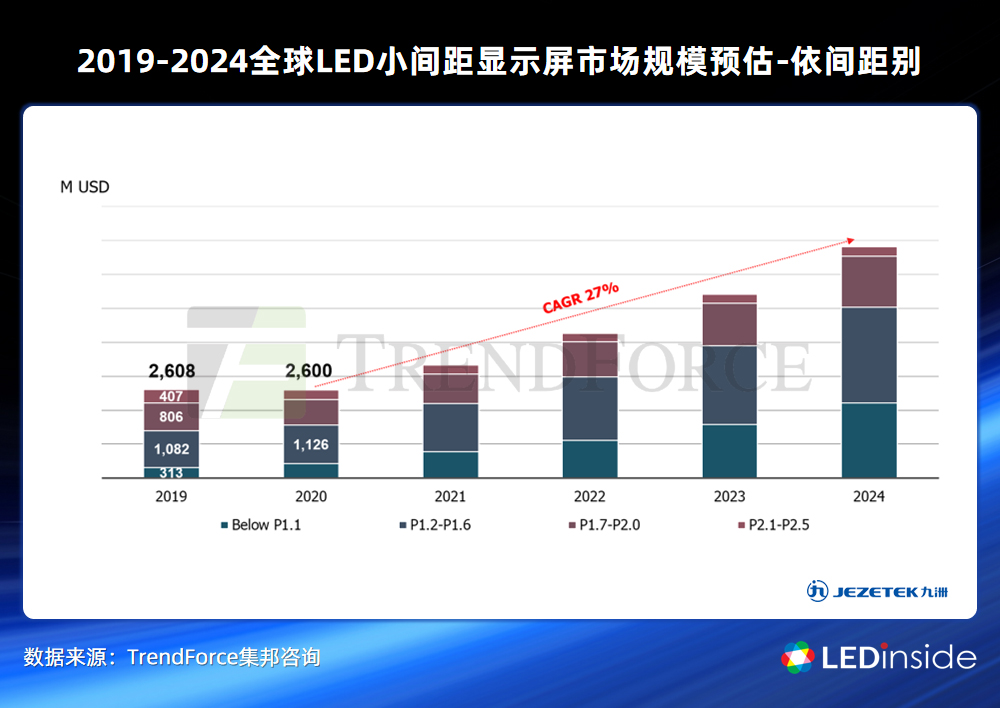

In 2020, the global small-pitch LED display market size is 2.6 billion US dollars, which is basically the same as last year. The main reason is that the annual mainstream shipment pitch continues to move down, and the shipment of displays below P1.0 is also increasing year by year, pulling up Therefore, despite the impact of the epidemic, the small spacing display can still maintain the same market size as last year. As the trend of smaller spacing continues to ferment in the future and the application places expand, it is estimated that the CAGR from 2020 to 2024 will be 27%. Continue to maintain rapid growth.

As the leading small-pitch display manufacturers such as Leyard and Unilumin have successively launched smaller-pitch products, coupled with the gradual increase in consumer demand for display effects, with the further decline in cost, P1.2~P1.6 and Products with smaller spacing below P1.1 will have the most growth momentum, especially below P1.1, due to the high unit price and the current low base, it is estimated that its CAGR from 2020 to 2024 will reach about 50%.

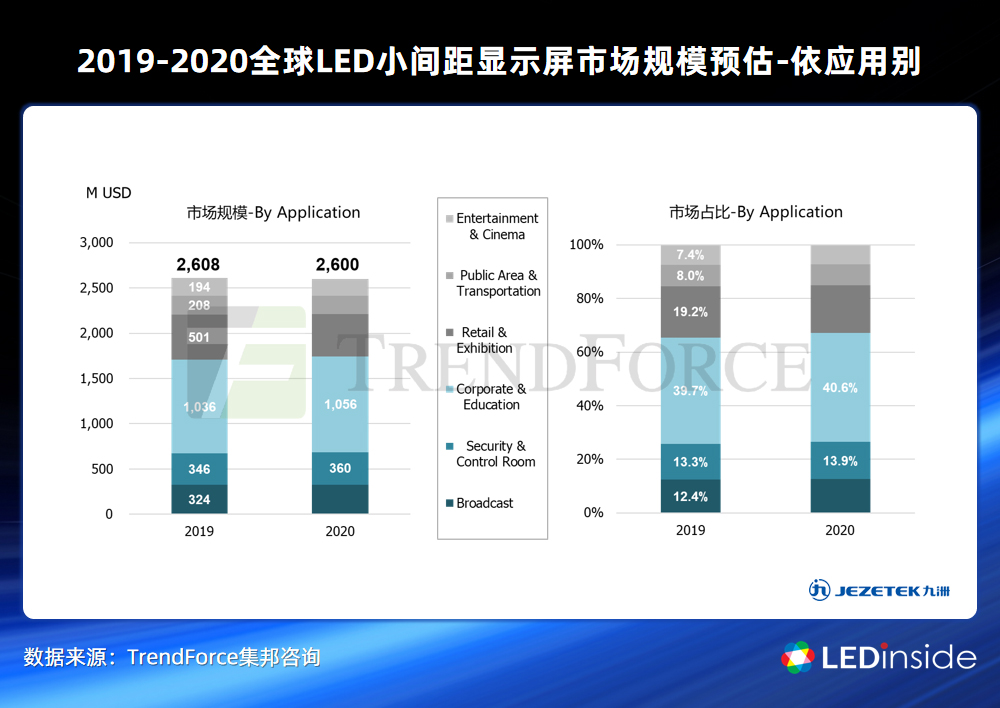

From the perspective of the regional market structure, the regions most affected by the epidemic this year are mainly North America and EMEA, which are expected to decline by 7.7% to 6.7% respectively this year, and the proportion will also decline accordingly. China is currently slowly recovering from the impact of the epidemic. Coupled with the stimulus of the new infrastructure policy, the Chinese market is expected to maintain the fastest growth rate in the world this year, with a YOY of about 3.8%. The most affected markets this year are mainly application places related to gathering activities, such as movie theaters, and commercial retail and other places. However, for security monitoring or control rooms, this year will benefit from the government's new infrastructure policy. It is estimated that this will also be the fastest growing application market this year, and the market share is estimated to increase from 13.3% to 13.9%. %. In addition, in the conference room or lecture hall market of enterprises and education, as the current small-pitch display is undergoing a gradual transition from to G to to B, manufacturers are actively promoting product expansion channels, and the application side is still a high-end commercial display market. The rate is low and the impact of the epidemic is limited, so this market is also worth looking forward to this year. It is estimated that the market share will increase to 40.6%.

At present, in the commercial display market, divided by display size, LCD display panels below 80 inches are mainly LCD display panels, while those above 80 inches are mainly projectors and LED displays. The machine market will be divided up by LED displays.

If the shipment volume of LED display all-in-one machines is calculated according to the specifications of P1.5 and 140 inches, and the current market average price is taken, it is estimated that about 35,000 sets of LED display all-in-one machines will be shipped globally this year, and it is estimated that they will be released by 2024. The goods will reach 192,000 sets. The total annual shipment of the commercial projector market is about 6-7 million units.

As the cost of LCD decreases and the size continues to expand, LCD TVs and electronic whiteboards of more than 80 inches have been introduced into commercial use. Coupled with the rise of the LED display market, the number of commercial projectors shipped in corporate meeting spaces will also increase. year by year.